ESG investing or as many call it, socially responsible investing, has gained popularity amongst the younger generations. Unfortunately, there still is a large majority of stakeholders that know little to nothing about it. It also does not help that advisors are providing much information about it either. The three tenets of ESG are the Environmental, Social, and Governance (ESG) guidelines that a company may observe in order to prove they are performing business practices in a socially responsible manner. ESG criteria are beginning to become crucial in the selection process for ethically driven investors (Chen, 2020).

A Global Perspective

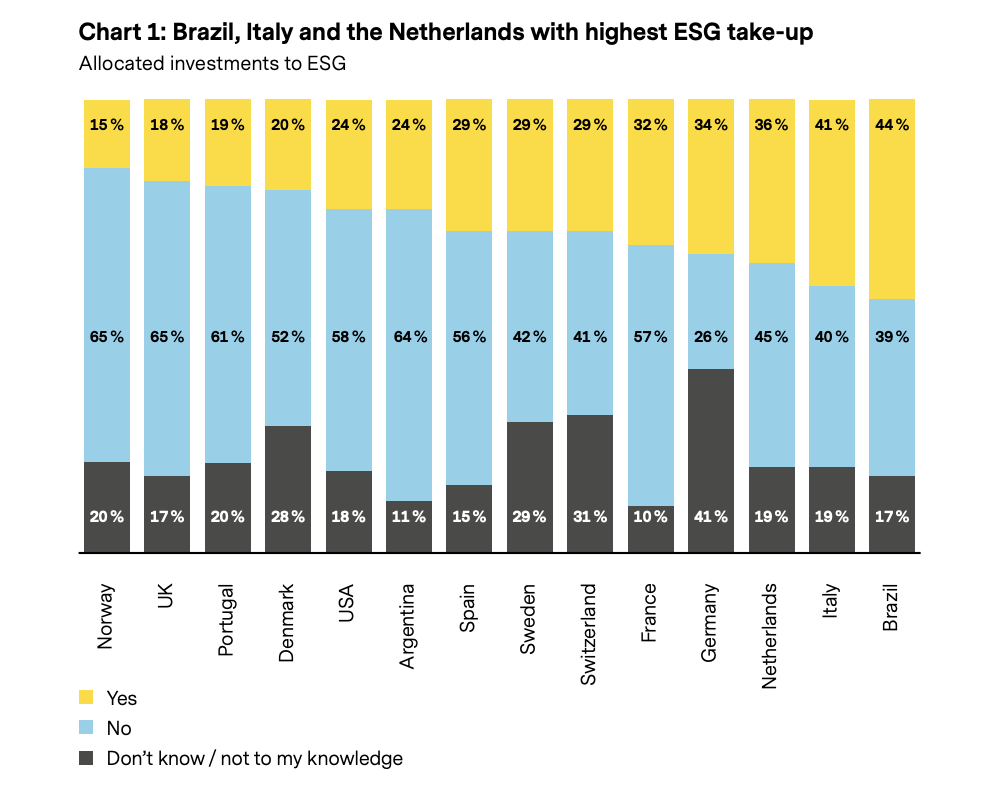

Though the United Kingdom is considered to be a leader in ethical investing, more than 60 percent of individuals in the UK have never heard of ESG investing. Norway, a place with a similar reputation, falls around the same amount (Schwarzer, 2019). Unfortunately, the lack of awareness regarding ESG can mostly be attributed to advisors who withhold socially responsible investment opportunities from their clients. Research suggests advisors are not taking full advantage of the opportunities that ESG investing can provide.

Benefits of Bringing ESG Investments to Light:

- Reputation Amelioration: Advisors that chose to tell clients about ESG investments are more likely to be viewed as trustworthy and hold a good image for themselves. By giving customers the chance to invest in a company that plays a positive role in society that will also give them a financial return, this is a win-win situation.

- Benefiting from the Bandwagon: Whether advisors want to acknowledge it or not, ESG investing is growing rapidly as new stakeholders arrive. From a survey of over 2,000 from Vontobel, they found that 73% believe that businesses need to be held more accountable to perform in ethical conditions. 50% of the same group believe that their money should be used to better society in some aspect (Schwarzer, 2019). If your company would like to find receive an ESG report to figure out your ranking, go to Hydrus.ai for a free demo.

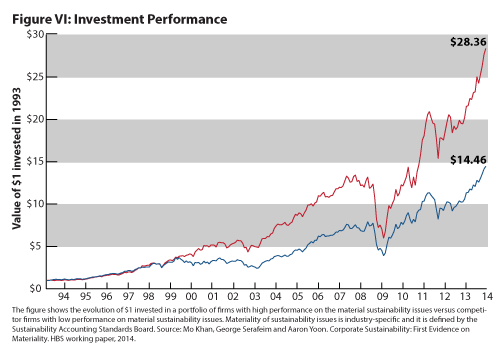

- Raising Returns: George Serafeim, a Harvard Business School Professor found that companies that choose to dedicate efforts into socially responsible activities performed better than those who don’t. George wrote that “Investing $1 in 1993 grows to $28 in 2013 by investing in a portfolio of firms with good performance on material sustainability issues. In contrast, investing in a portfolio of firms with poor performance on material sustainability issues would return just over $14 during the same time period” (Serafeim, 2016).

He follows this up by displaying this graph:

As ESG-minded investors grow in numbers, so should the number of advisors who recommend ESG investing. There are clear advantages to implementing more high ESG businesses into investing recommendations so that both parties are satisfied.

Sources:

[1] Chen, J. (2020, March 02). Environmental, Social, and Governance (ESG) Criteria. Retrieved June 19, 2020, from https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp

[2] Schwarzer, Axel. “Act ESG: Closing the ESG Knowledge Gap.” Https://Www.vontobel.com/En-Int/, 2019, sfama-cms.cdn.prismic.io/sfama-cms%2Fab843ade-6883-4d71-aaba-ad81d91cb8ff_study_act+esg_+closing+the+esg+knowledge+gap.pdf.

[3] Serafeim, G. (2016, July 28). Turning a Profit While Doing Good: Aligning Sustainability with Corporate Performance. Retrieved June 19, 2020, from https://www.brookings.edu/research/turning-a-profit-while-doing-good-aligning-sustainability-with-corporate-performance/