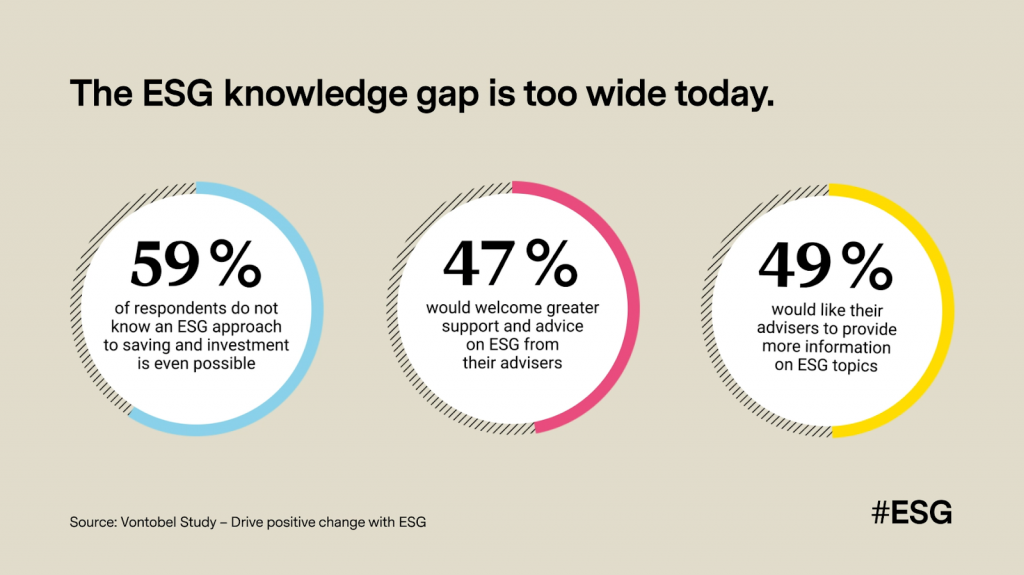

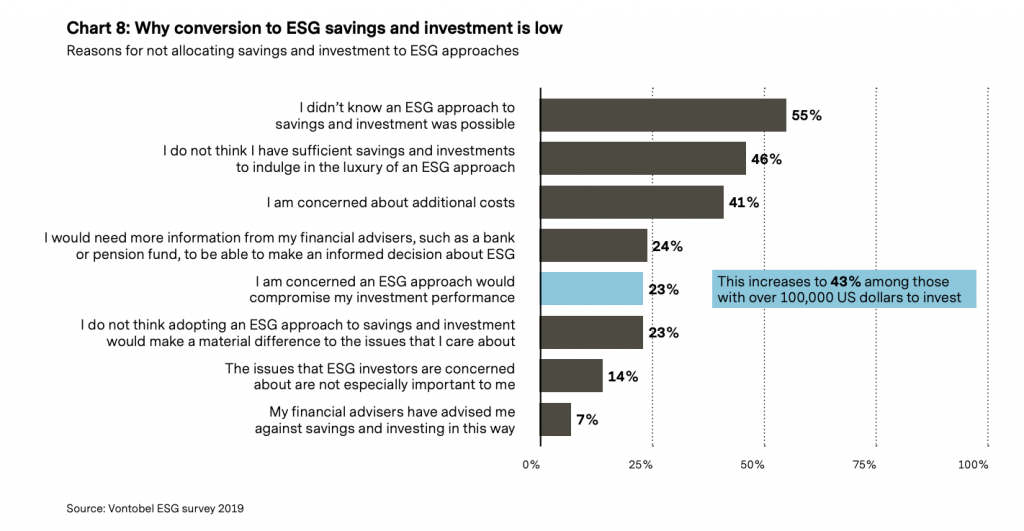

More than half of the households in the United States have some level of investment in the stock market, yet 59% of stakeholders do not know about or have not heard of ESG investing. Environmental, social, and governance (ESG) standards are often overlooked by investors of all socioeconomic standings, though differences can be observed as income brackets progress. The level of unfamiliarity increased to 61% when individuals earning less than $100,000 per year were asked. The wealthiest are more informed about ESG investing yet 35% still say “they know little about it”[1].

So What May be the Causes of the Knowledge Gap Around ESG?

Choice of Language: The term ESG is not widely known and can be confusing for many who are just beginning to become familiar with the lexicon. Most refer to the concept of ESG as simply, ‘sustainability’.

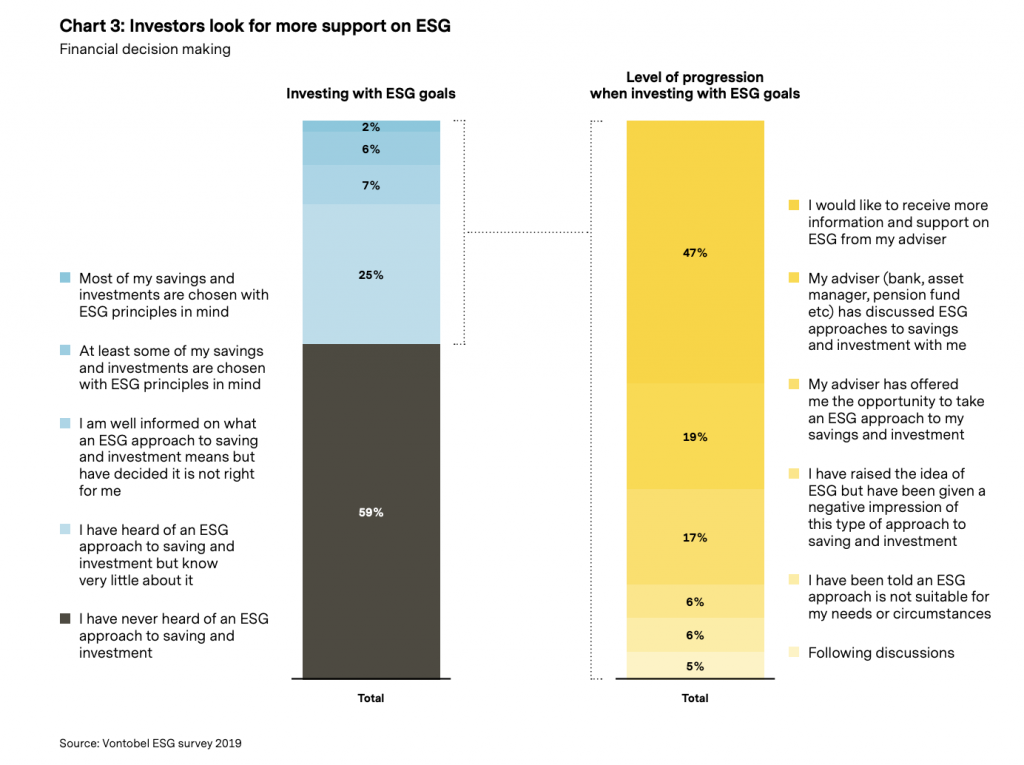

Advisors’ Neglect: Financial advisors familiar with ESG standards often chose not to bother to explain what it is to investors, even though 47% of stakeholders have admitted that they would like to be more informed about possible ESG investments. Vontobel conducted a study survey taken by 4,643 consumers across 14 markets in Europe, North America, and South America. Unsurprisingly, “only 19% have ever discussed ESG approaches with their adviser, while only 17% have been offered opportunities to save and invest this way” [1].

The ESG Misconception: Individuals that are only somewhat familiar with ESG may write it off due to some common misunderstandings. From the same survey from Vontobel, they found that 48% of investors believe that they do not have enough money for such a luxury investment. Investors are unaware that their apprehensiveness is contradictory to actual statistics and price estimates as ESG investments hover around the same price as other common investments. Vontobel also found that 21% think that the return on the ESG investment would be compromised, though data has also refuted this idea. If you are a company looking for a free demo to see your ESG rating, visit Hydrus.ai.

Awareness is Growing in the Next Generation of Investors

The ESG knowledge gap is prevalent today but is shrinking as new waves of investors continue to approach. Shareholders are beginning to grasp the importance of holding businesses accountable regarding their ethical behavior, and are starting to believe that companies that chose to invest in ESG often have a better financial standing and reputation [1]. Millennials and Generation Z have shown promising awareness by demonstrating their desire to invest their money into companies that contribute to the betterment of their environmental, social, and governance standards (50%). Though you may be unfamiliar with ESG, you can quickly gain an understanding through hydrus.ai.

[1] Schwarzer, Axel. “Act ESG: Closing the ESG Knowledge Gap.” Https://Www.vontobel.com/En-Int/, 2019, sfama-cms.cdn.prismic.io/sfama-cms%2Fab843ade-6883-4d71-aaba-ad81d91cb8ff_study_act+esg_+closing+the+esg+knowledge+gap.pdf.