What is ESG Ratings and why is it so Important?

Today’s investors are beginning to look beyond the bottom line to understand company value and long-term sustainability. ESG (Environmental, Social, Governance) disclosure provides investors with a way to identify and understand key issues that aren’t typically accounted for on a traditional balance sheet yet have a critical impact on a company’s risks and opportunities.

ESG is linked to sustainability, specifically the environmental and social responsibility associated with business sustainability.

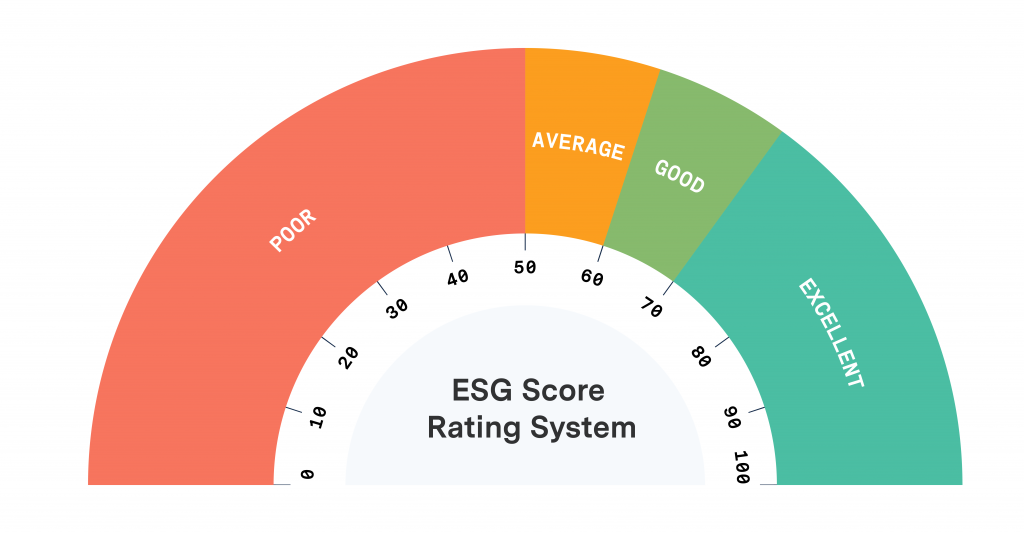

Reporting on ESG is an up-and-coming way for companies to prove that they have a positive impact on society and the planet. Investors are increasingly applying non-financial ESG factors as part of their analysis process to identify material risks at companies. Public companies often provide ESG related information, an ESG report, to help investors assess the sustainability of a company. ESG directories like CDP and ratings companies like Morningstar use these ESG reports to produce a proprietary ESG score for companies. There is no one standard for ESG reporting. The most common frameworks are GRI, SASB, CDP, GRESB, SFDR, TCFD, NGER, SECR and SDG. Each has their own methodology and assessments. With an estimated $17 trillion in sustainable investment capital on the line, the stakes are high for companies and investors to make sound ESG decisions. To do this, institutions such as asset managers, pension funds, and endowments, often rely on ESG scores.

Leaders in ESG Reporting

While there are hundreds of rating agencies that provide ESG scores, some of the prominent ESG score providers include Bloomberg ESG Data Services, Dow Jones Sustainability Index, MSCI ESG Research, Sustainalytics, Thomson Reuters ESG Research Data, S&P Global, ISS ESG, Fitch Ratings, and Moody’s Investors Service.

Benefits of Good ESG ratings?

A good ESG rating is beneficial for a number of reasons:

- ESG rating is used by investors to decide whether or not to invest in a company.

- Some governments use ESG rating to help determine whether a company can operate within its borders.

- Gives holistic view of working practices and operational performance.

As per Urban Footprints, as of December 2021 in the U.S., financial investment in actively managed ESG fund assets summed $357 billion in December 2021—up 51% from $236 billion in 2020. Clearly, investors are paying attention to and backing ESG-focused companies—and it’s paying off. Further to back this information, as per Accenture’s blog post-dated January 20, 2022, “between 2013 and 2020, companies with consistently high ESG performance tended to score 2.6x higher on total shareholder return than medium ESG performers.” When companies benefit from investing in one business with an excellent ESG score, they are likely to expand their portfolio and continue this investing strategy.

Tips to improve the ESG Score

Below are 6 effective points which will help to align the company in line with the methodology used by the rating giants.

Identify the Key ESG Drivers for Your Company

The first step in building a formidable ESG strategy is identifying what aspects of your business drive ESG performance. In terms of the environmental aspect of ESG, main drivers include energy usage and source (renewable or fossil fuel-based), water usage, waste production and CO2 emissions. As for the social side of ESG, key drivers could be engagement with the community, donations to social causes, or other initiatives that contribute to the betterment of society. Finally, some drivers for the governance aspect of ESG could be a positive corporate culture, inclusive hiring processes, or the vetting of suppliers to ensure proper working conditions throughout your value chain.

Align ESG factors with your business strategy

The integration of environmental, social and governance (ESG) principles in your corporate strategy is no longer a should-do, but a must-do. Unless you take a position on ESG factors, you will lag behind the competition. With the rise of ESG investing and increased public pressure on all organisations to be transparent about their environmental, social and governance policies, it has become indispensable for businesses to establish an ESG strategy. But rather than reacting impulsively to external influence, it should be based on a balance between stakeholder preferences and business priorities. In short, ESG is a core element of your business strategy.

Collect Plenty of Data Points

This step is integral to tracking the effectiveness of your ESG program and reporting progress to stakeholders. As numeric data is the most verifiable and easiest to track, getting this type of data is preferred. Of course, some drivers such as “positive corporate culture” are much more difficult to quantify than “energy usage,” so you may have to rely on some qualitative data as well. That being said, surveys are an excellent way to get numeric data on subjective aspects of your company’s ESG performance.

Develop an ESG-oriented culture within the organization

When ESG reports are determined by senior management, they evolve as a requirement to ensure that they are propagated throughout the organization and that each employee is aware of them. Research shows that in firms where employees feel highly motivated, communication, recognition, and management of ESG challenges are likely to be far more efficient. That’s to say, integrating ESG practices into your corporate culture makes everything easier for your company.

Set Ambitious Yet Reasonable ESG Goals

When setting your ESG goals, base them on the key ESG drivers for your company and the results of your materiality assessment. Linking environmental goals to UN climate targets can also help by adding context to your pursuits and by showing that your goals are evidence-based. Setting ambitious ESG goals is a sure way to foster a sense of urgency and increase the likelihood that action will follow. However, be wary not to overcommit. While overdoing your ESG strategy is better than not having one at all, overcommitting to ESG can be a drain on employees’ time and focus. Also, under-delivering on ESG commitments can be seen as a form of greenwashing and thus can inflict serious harm on your company’s reputation.

Feedback Monitoring Loop and Transparency

This is the key matrix which links the ground reality with the management views.

Finally, based on all the ESG groundwork your company has done up to this point, it’s time to create an action plan and put it into practice.

This involves:

- Proper tracking and improving energy efficiency

- Effectively minimizing the waste

- Employee centric nature i.e., Consider employee health, safety, and security

- Improve worker satisfaction

- Transparency with the investors and public statements

Effective communication with internal and external stakeholders is essential to understanding the company’s engagement to long-term value creation and develop a shared understanding with stakeholders about a company’s ESG strategy and inclination. In this sense, publicly open disclosures and reports are the most efficient communication tools of your dialogue with investors and stakeholders.

***

Source:

- https://www.gobyinc.com/esg-scores-why-they-matter/

- https://www.accenture.com/us-en/insights/strategy/measuring-sustainability-creating-value

- https://urbanfootprint.com/esg-scores-meaning/#:~:text=According%20to%20a%202022%20report,to%20expand%20their%20portfolio%20and

- https://greenbusinessbureau.com/topics/sustainability-benefits-topics/esg-and-sustainability-how-to-improve-your-esg-score/

- https://sanctionscanner.com/blog/how-to-improve-esg-score-630