In 2021, $649 billion flowed into ESG-focused funds worldwide, up from $542 billion and $285 billion in 2020 and 2019. There is no agreed-upon definition of what the investment strategy looks like, besides coherence on what the acronym stands for — environmental, social and governance factors that funds take into consideration while analysing the sustainability of a company.

ESG ratings are designed to measure and assess a company’s long-term exposure to ESG risks and its performance in managing those risks relative to industry peers. Companies that measure and rate ESG performance include but are not limited to: (i) Bloomberg ESG Data Services; (ii) Dow Jones Sustainability Index; (iii) MSCI ESG Research; (iv) Sustainalytics; (v) Thomson Reuters ESG Research Data; (vi) S&P Global; (v) ISS ESG; etc.

The issue occurs when there are multiple projections for the same company. To understand this better, let’s go through the details shared by GreenBiz on May 03, 2022 – Consider how the confusion feeds the current ESG scores for Chevron Corporation. On Sustainalytics, Chevron has a ranking of 43.0 and is placed in the severe category (the highest risk category). But on MSCI, Chevron has a ranking between 4.2 and 5.7 and is placed in the risk category of “average” as opposed to the worst risk category of “laggard.” Two credible ratings agencies who conduct extensive research on the companies they assess should not come up with such different scores. An asset management firm could arbitrarily choose to use the scores of one agency over another and arrive at significantly different investment decisions.

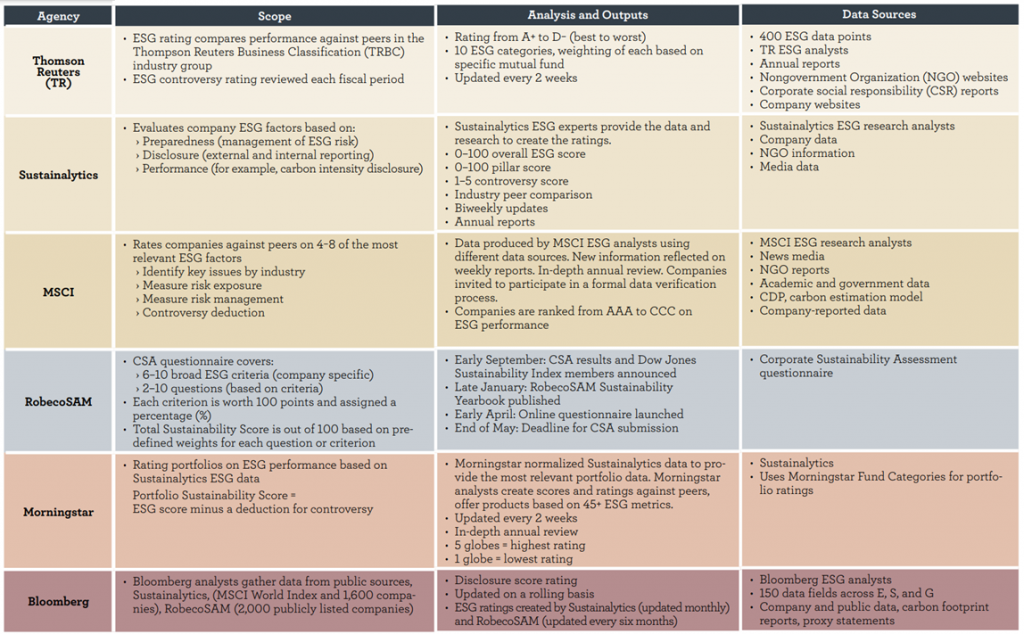

Let us have a bird-eye view on methodologies and reporting metrics different rating agencies follows.

MSCI ESG ratings focus on a company’s exposure to financially relevant ESG risks and rank potential investments on a letter scale from AAA (“leaders” on ESG) to CCC (what MSCI calls “laggards”). MSCI ESG ratings evaluate each of the environmental, social, and corporate governance factors separately focusing on key issues. For environmental, these key issues include contribution to climate change, utilization of “natural capital” (such as raw materials sourcing), pollution, waste management, and a company’s use of green technologies and renewable energy. For social, key issues include health and safety, consumer safety, community relations, and social opportunities. For governance, MSCI ESG ratings emphasize corporate fairness, accountability, transparency, and ethics. Within each of these categories, MSCI scores a company on each key issue from zero to ten and incorporates exposure to controversial business activities (such as tobacco and weapons) into the process. Scores are ultimately aggregated, weighted, and scaled to the relevant industry sector to arrive at an overall ESG rating.

Another established ESG ratings provider, Sustainalytics, measures a company’s exposure to industry-specific material ESG risks and evaluates how well a rated company is managing those risks. Sustainalytics categorizes ESG risks into five categories, ranging from “negligible” to “severe” based on a quantitive score. Under its scoring approach, the final risk category can be applied across multiple industries such that ESG performance for a company in one industry can be compared against the ESG performance of a company in an entirely different industry.

S&P Global’s ESG rating, on the other hand, utilizes a proprietary company-specific assessment based on questions answered by the corporation, combines those responses with publicly available data points, and then categorizes and weighs the data points to come up with a score that is based on financial materiality for each industry. S&P Global looks at a company’s exposure to observable ESG risks and evaluates the company’s preparedness for, and ability to adapt to, a variety of long-term plausible disruptions. S&P Global then rates ESG performance by applying a numeric score ranging from 0 to 100.

Refer to below chart to understand how different ESG Ratings companies work.

What drives ratings divergence

- Possible structural bias in ratings assessments: The largest cause of bias appears to be that ESG ratings depend fundamentally on disclosure. This is inclined to favor:

- Large companies that tend report on ESG factors in greater proportion and have the financial resources to pay specialist consultants to complete questionnaires;

- English-speaking companies, as much research is undertaken by English-speaking analysts;

- European-domiciled companies who are more aware of the size and influence of sustainable investment.

Bias in ratings assessments leads to a lack of impartiality that can distort a company’s true ESG performance.

- Weight divergence can happen when agencies assign varying degrees of importance to attributes, valuing human rights more than lobbying, for example.

- Measurement divergence occurs when ratings agencies measure the same attribute using different indicators. One might evaluate a firm’s labor practices on the basis of workforce turnover, while another counts the number of labor cases against the firm. While both capture aspects of a firm’s labor practices, they are likely to lead to different assessments, the research cautions.

- Scope divergence can occur when one agency includes greenhouse gas emissions, employee turnover, human rights, and corporate lobbying in its ratings scope, while another doesn’t consider lobbying.

- Data acquisition and data processing: To acquire a company’s data, rating agencies use different processes including companies’ sustainability reports, surveys sent directly to companies, engagement with companies (e.g. through meetings, interviews or workshops) and other sources of information. In order to deal with unreported data or data inconsistencies, ESG rating agencies often use in-house statistical models to create estimates based on market averages and trends. The diverse data collection processes as well as different estimation models for unreported or inconsistent data create further divergence in ESG rating and rankings

In addition, the team also identified a “rater effect” — when the ratings agencies’ assessment of a company in individual categories seemed to influence their views of the company as a whole. Specifically, when a rater judged a company as positive for a particular indicator — human rights, say, or labor practices — they were then more likely to judge other indicators as positive too.

Because different ratings agencies utilize their own methodologies and scoring systems when evaluating ESG factors with no uniform standard across the industry, it is important for any entity relying on an ESG rating to understand the methodology being utilized and what it means for their particular purpose. We can expect that as ESG issues increase in importance in investment and credit decisions, ratings providers, and the systems they use to evaluate and score ESG factors, will mature and evolve as well.

Hydrus.ai is an Environmental, Social, and Governance (ESG) software platform focused on helping corporations and asset managers properly collect, report, and analyze critical yet divisive sustainability data with AI and ML. Hydrus aims to be an organization’s ESG operating system. The Hydrus philosophy is unlike any other ESG software platform that is on the market. At Hydrus, we have mapped all of the major ESG standards within our platform and have crossed mapped them so that if one standard asks for the same thing as another standard, you don’t have to enter it in more than once saving time and money. Additionally, during the data collection process, not only do we collect data, we collect information on who is responsible for the data, who made changes to the data, time collected and any other supporting documentation. This allows for data to be audited by a third party and allows for a transparent data trail. Again, cutting down on time and money. Our goal is to help companies disclose their data as simply and as accurately as possible.

Source:

https://esgnavigator.com/knowledge-hub/esg-ratings-library/abcs-of-esg-ratings-reporting/